Financial Health Check

Take control of your finances with a 1-time plan from a CFP® professional

A 5-part personalized plan to help you finally understand where your money is going and how to achieve your goals. Without the obligation of a long-term advisor relationship.

Never live paycheck-to-paycheck again.

Featured In:

Is a Financial Health Check for you?

Do any of these sound like you?1. The "High Earner, Low Saver"

You’ve climbed fast in your career and your income looks great on paper — yet you never seem to get ahead. You want a clear plan that matches your income to your goals.2. The "Debt Juggler"

You’re earning more than ever, but student loans, credit cards, and lifestyle creep are making it impossible to build momentum. You need a strategy to finally become debt-free.3. The "Validation Seeker"

You're trying to do everything right, save, invest, pay off debt, but you're not sure what to prioritize or if you're on the right track. You want expert feedback for clarity and confidence.If any of these sound familiar...then the Financial Health Check was designed for you.

Your Financial Planner

Hi, I'm Benjamin Daniel, a Certified Financial Planner® professional with over 15 years of experience in the financial services industry.I specialize in helping high-earners (~$90k+) in their 20s, 30s, and 40s get their finances organized, eliminate debt, and begin building lasting wealth.I've been featured in popular outlets including Investopedia, MarketWatch, Kiplinger, and U.S. News & World Report — all for simplifying complex financial topics into clear, actionable guidance.

Benjamin Daniel, CFP®

Founder, Money Wisdom

No more living paycheck-to-paycheck...

Finally, a clear path from feeling broke to financial growth

All high-earners trying to take control of their finances face the same 8 problems:

Priority Confusion: Wondering if you should be paying off debt, saving for emergencies, or investing.

The Income Paradox: Frustration from making a solid income, but not having much to show for it.

Emergency Fund Anxiety: You're one unexpected expense away from being in credit card debt.

Low Spending Visibility: You don't know where all of your money is going each month.

Saving Uncertainty: You're unsure how much you should be saving for both short-term goals as well as financial independence or retirement.

Blind Spots: You wonder how you should be preparing for goals like buying a home, getting married, and having a child.

Missed Opportunities: You wonder if you're missing strategies for lowering your taxes & building wealth.

And through the Financial Health Check, we eliminate each problem you face, one by one.

Know Exactly Which Financial Step to Take Next…Stop Second-Guessing Every Move

The big mistake high-earners make?Using well-intentioned advice that doesn't fit their situation.I don't believe in a lot of generic financial advice. I believe the best plans are based on your unique values, goals, and financial position.This minimizes wasting money on the wrong things at the wrong time.A custom plan is the best way to have confidence in the next financial step for you to take.(Note: I've seen this time and time again: people take well-meaning advice that isn't a great fit. For example, buying a home too soon, investing in a complex strategy, or over-optimizing for credit card points.)

Build a Financial Cushion…Reduce Your Anxiety

Another big mistake high-earners make?They try to find ways to save for an Emergency Fund—but focus on the wrong things.They cut things they've been told to "feel bad" about buying, but don't necessarily move the needle. Think an occasional appetizer or treating yourself to coffee.Usually, there are "bigger ticket" expenses that will help them save faster while allowing them to enjoy spending on the things they love.(Proof: Multiple academic studies show that making things feel restrictive almost always backfires.1)

Actually Get Results from Your High Income…Turn Your Hard Work into Real Wealth

A final big mistake high-earners make?Trying to rely on willpower to save & invest.Relying on willpower in today's age is a recipe for failure: we're flooded with advertisements, messages, and social media trying to get us to spend…The way to win today is by building a system to automate your savings goals.Once you automate your preferred behavior, you never have to rely on willpower again.(Note: A landmark study showed people who automated their savings more than tripled their savings rate within 4 years.2)

Featured In:

How the Financial Health Check Works

The Financial Health Check is a one-time financial plan delivered as a comprehensive written report.There are 3 steps:

1. Intro Call

First, a brief (20 to 30) minute Introductory Call to make sure we're a good fit.

2. Get Organized

Next, you'll complete simple forms to organize your financial information.

3. Get Results

Get your plan within 10 business days and start to implement to get results.

Your complete Financial Health Check includes:

Your Written Financial Plan: A comprehensive analysis of your financial situation by a Certified Financial Planner® professional.

Your Personalized Action Plan: A prioritized, step-by-step list of action steps to implement the recommendations.

Question & Answer Support: Ask any questions about your plan to make sure you have a complete understanding.

Everything you need to build momentum without a long-term commitment (or ongoing fees), a series of Zoom calls, or investment management.It's designed for how high earners live and make decisions today: on their terms, in private, and easy to act on.Here's exactly what you'll find inside your Financial Health Check (and how it helps you take control of your finances)...

What's Included in a Financial Health Check?

The Financial Health Check consists of 5 component reports, each designed to give you a clear, data-driven view of your finances, insights, and recommendations:

📊 Part 1: The Financial Position Report

Understand exactly where you stand today.The Financial Position Report is a complete review of your Net Worth, a snapshot of your assets, debts, and overall financial health.You'll get a Net Worth Statement so you can see all of your accounts in 1 place, and how each piece of your financial life connects to build wealth.You'll also receive clear, expert feedback on where you stand across your assets and liabilities, given your unique values and goals. This report will establish a baseline for you to track future progress.

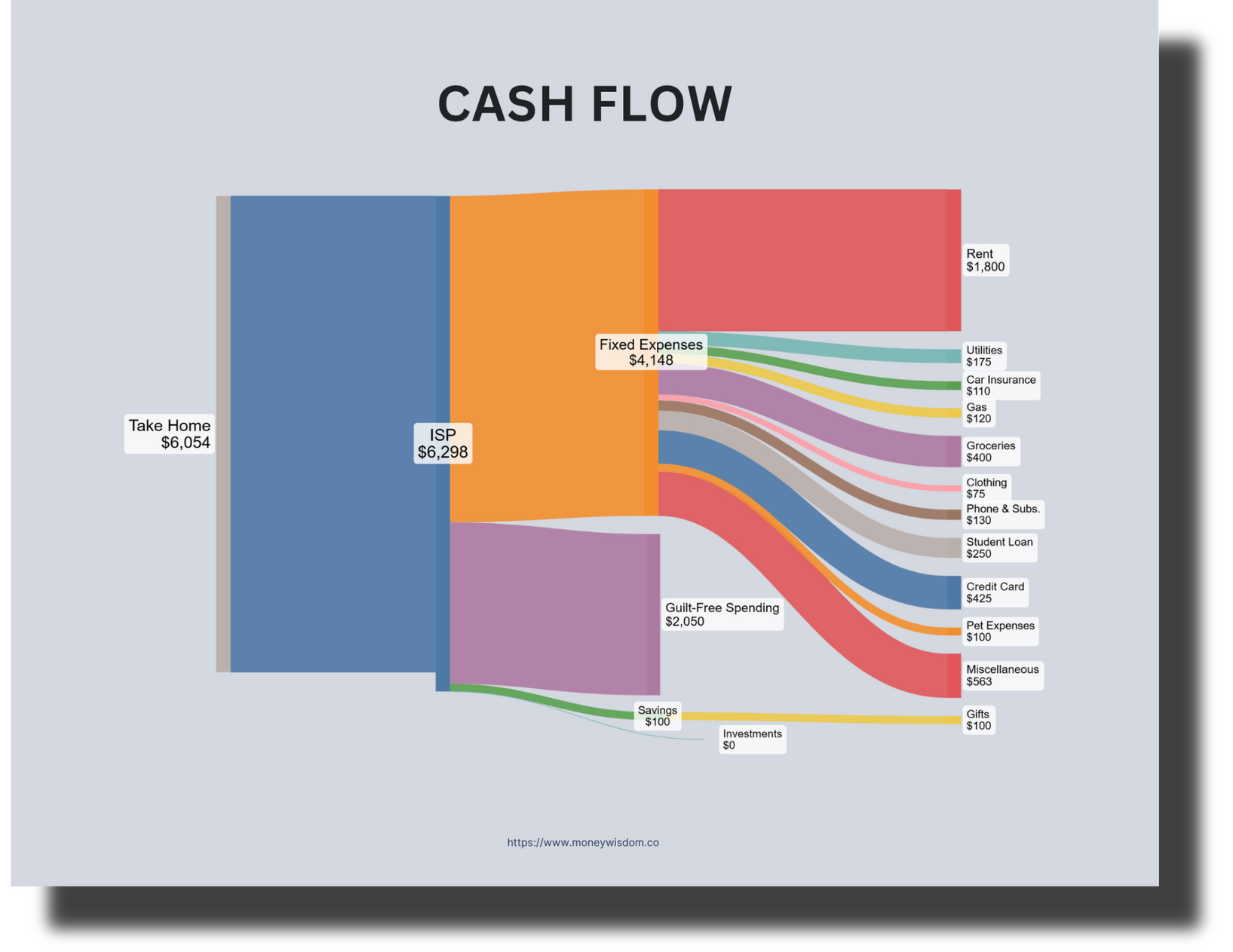

📊 Part 2: The Income & Spend Report

Finally see where every dollar is going.The Income & Spend Report breaks down your income, spending, savings, and investing rates, showing exactly how your money flows through your finances.Included is a Sankey Diagram Cash Flow Visual — a simple, powerful way to see exactly where your money is going each month, so you can see what's working and spot what needs adjustment.This part of your plan can provide one of the biggest "aha" moments — when you can finally see your full cash flow picture in one place.

📊 Part 3: The S.W.O.T. Analysis Report

Know your strengths, weaknesses, opportunities, and threats.The S.W.O.T. Analysis Report transforms all of your data into high-level insight.Every individual's financial situation has strengths to build on and areas for improvement (weaknesses).There's also always opportunities to improve your finances as well as threats to consider and risks to mitigate.This part of your plan makes it crystal clear where you've done well and how to take your finances to the next level.

📊 Part 4: The Q&A Report

Personalized, expert answers to your most important financial questions.The Q&A Report provides feedback on your biggest money questions. This includes questions like:

How much to save

How to balance paying off debt versus investing

Whether you can afford a home

Where to reduce spend & redirect savings

Each answer is tailored to your situation, including your values, goals, and financial position.

📊 Part 5: The Action Plan Report

Your personalized roadmap to more forward strategically and confidently.The Action Plan Report is a prioritized, easy-to-follow sequence of actions that turns all of the analysis, insights, and recommendations into a step-by-step plan.This is your playbook for taking action and making progress on your goals.

How Valuable is a Financial Health Check?

A Financial Health Check gives you clarity, confidence, and personalized recommendations.Sometimes, the biggest value is expert confirmation that you're on the right track. Other times, it's spotting opportunities you didn't know existed.An example of a typical Financial Health Check:✅ Identify missing employer match contributions, often worth $3,000+ per year

✅ Gain confidence in financial decisions and stop second-guessing every move

✅ Discover ways to accelerate debt payoff and save $1,000–$2,000 in interest

✅ Create an automatic investing habit that builds $1,000+ in the first year alone

✅ Establish a proper emergency fund for peace of mind that money can’t buyClarity, confidence, and potentially thousands of dollars in savings and gains.And you can get the Financial Health Check for $225 during the Introductory Pricing period.Here's why: As I establish this service, your feedback is incredibly valuable. And if you find the Financial Health Check helpful, your testimonial helps others discover how they too can take control of their finances.

Additional Resources

To support your progress, you'll also get 3 "Bonus" resources...

✅ ["Bonus" Resource #1] The Financial Automation Guide

Turn good intentions into effortless execution.Inside this step-by-step guide, you’ll learn how to set up an automated system to manage your money efficiently—from saving and investing to paying bills and tracking goals.

You’ll discover:

How to align your paydays with saving and investing schedules

How to build an automatic flow that funds your priorities

How to remove friction and make smart choices happen by default

You'll learn exactly how to make everything run in the background.

✅ ["Bonus" Resource #2] The Investing Fundamentals Guide

Learn the principles behind building lasting wealth.This guide walks you through the fundamental concepts every investor needs to understand.

You'll learn:

How diversification really works

Why minimizing costs and taxes matters

The major types of accounts and investments

You’ll walk away confident about how investing fits into your overall plan.

✅ ["Bonus" Resource #3] Two Email Check-Ins

Stay on track with gentle guidance and expert support.One month and two months after you receive your plan, you’ll get personalized email check-ins to see how your implementation is going.You can share updates, ask clarifying questions, or get advice on maintaining momentum.

Your Financial Health Check Delivered

1-Month Later

Email Check-In #1

2-Months Later

Email Check-In #2

Ready To Take Control of Your Finances?

...And never live paycheck-to-paycheck again

As you've probably seen, the Financial Health Check covers a lot of ground.That's because to achieve my goal of helping individuals take control of their finances, I believe a comprehensive approach is best.And without the obstacles the industry has traditionally required: ongoing fees, pressure to pay for investment management, and the commitment of a long-term advisor relationship.So, you could spend your nights and weekends over the next couple months trying to piece all of your finances together on your own...Or, in just 2 weeks, you could finally know exactly where you stand, what to prioritize, and how to move forward with confidence. Through the guidance of a CFP® professional.And you can start building habits that can potentially increase your net worth by thousands in the first year alone.At the introductory period price of $225.But there are only 5 spots...and after those spots are filled, prices will increase.So, the question is:Do you want to keep spinning your wheels financially, or finally build a clear plan that achieves your goals?I hope it's the latter.

Still have questions? Happy to help!

1️⃣ Who is this for?This service is typically best for:✔️ Early to mid-career individuals (around $90k+ in income)

✔️ People who want clarity on their finances & steps to take to improve

✔️ U.S.-based individuals looking for expert guidance2️⃣ What are your credentials?I’m a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional with 15+ years in the financial industry, the last 6 years focusing on financial planning for individuals.I’ve also passed all three CFA® exams, which provides a deep understanding of investments. (Note: this service focuses on financial planning & general investing education, not investment advice).Popular media outlets, including Investopedia, MarketWatch, Kiplinger, & U.S. News & World Report, have also featured my financial education and advice.3️⃣ What do I need to provide for the Financial Health Check?I'll ask for a few key details (worksheets are provided):📊 Net Worth Template – A snapshot of what you own and what you owe

💰 Income & Spending Template – A high-level breakdown of your income & expenses

🔍 Answer a few quick questions – Like what you do for work and your biggest money questionThat’s it—just the essentials to ensure your Financial Health Check is as relevant and valuable as possible.4️⃣ How is my information kept secure?Security is a top priority. Here’s how your data stays protected:🔒 Encrypted File Storage – All documents are shared securely using encrypted cloud storage.

🛡️ Confidentiality – Your personal financial data will never be shared or used beyond the scope of your engagement.

🚫 No Third-Party Access – Only I will have access to the information you provide.5️⃣ Will you manage my investments or sell me anything?No, I don’t manage investments or sell financial products.Your Financial Health Check will provide you with analysis, guidance, and action steps based on your current financial situation.There’s no upsell, no ongoing commitment, and no sales pitch—just clear, objective financial feedback.6️⃣ How do I know if this will be valuable for me?If you’ve ever thought:• “I make good money, but I don’t feel like I’m getting ahead.”

• “I need a better plan for my savings, debt, and financial goals.”

• “I want financial clarity, but I don’t have time to figure it out alone.”Then this Financial Health Check is for you.It’s designed to give you clarity, confidence, and actionable next steps in an easy-to-understand format.

Satisfaction Policy

Finally, my personal commitment to you...Your Financial Health Check should bring you clarity, confidence, and peace of mind — not more confusion.If you don't feel you received at least 2-3x the value (or more) of your $225 investment, whether through gaining confidence, saving money, or identifying opportunities, just let me know within 14 days of receiving your plan.I'll review your feedback personally, and if the plan clearly missed the mark, I'll make revisions or refund your payment in full.This guarantee exists because my goal is to help individuals take control of their finances. I want to minimize your risk in taking the first step toward financial clarity and confidence.

Book an Intro Call (Free) 👇

Book a quick call (20-minutes) & we'll see if a Financial Health Check is right for you (the calendar below may take a brief moment to populate):

Additional DisclaimersCERTIFIED FINANCIAL PLANNER™ and CFP® are certification marks owned by the Certified Financial Planner Board of Standards, Inc. (CFP Board). My use of the CFP® marks does not imply CFP Board endorsement or recommendation.

Footnotes1 — Source: [A Theory of Psychological Reactance, 1966] https://psycnet.apa.org/record/1967-08061-000

2 — Source: [Save More Tomorrow TM: Using Behavioral Economics to Increase Employee Saving, 2024] https://www.jstor.org/stable/10.1086/380085